Latest News

Council Statement on Budget

Published: 17/02/2023

Flintshire County Council’s Cabinet meets on Thursday, 23 February to make final recommendations for setting a balanced budget and Council Tax levels for the 2023/24 financial year. Their recommendations will then be presented at a full Council meeting later the same day, for a final decision.

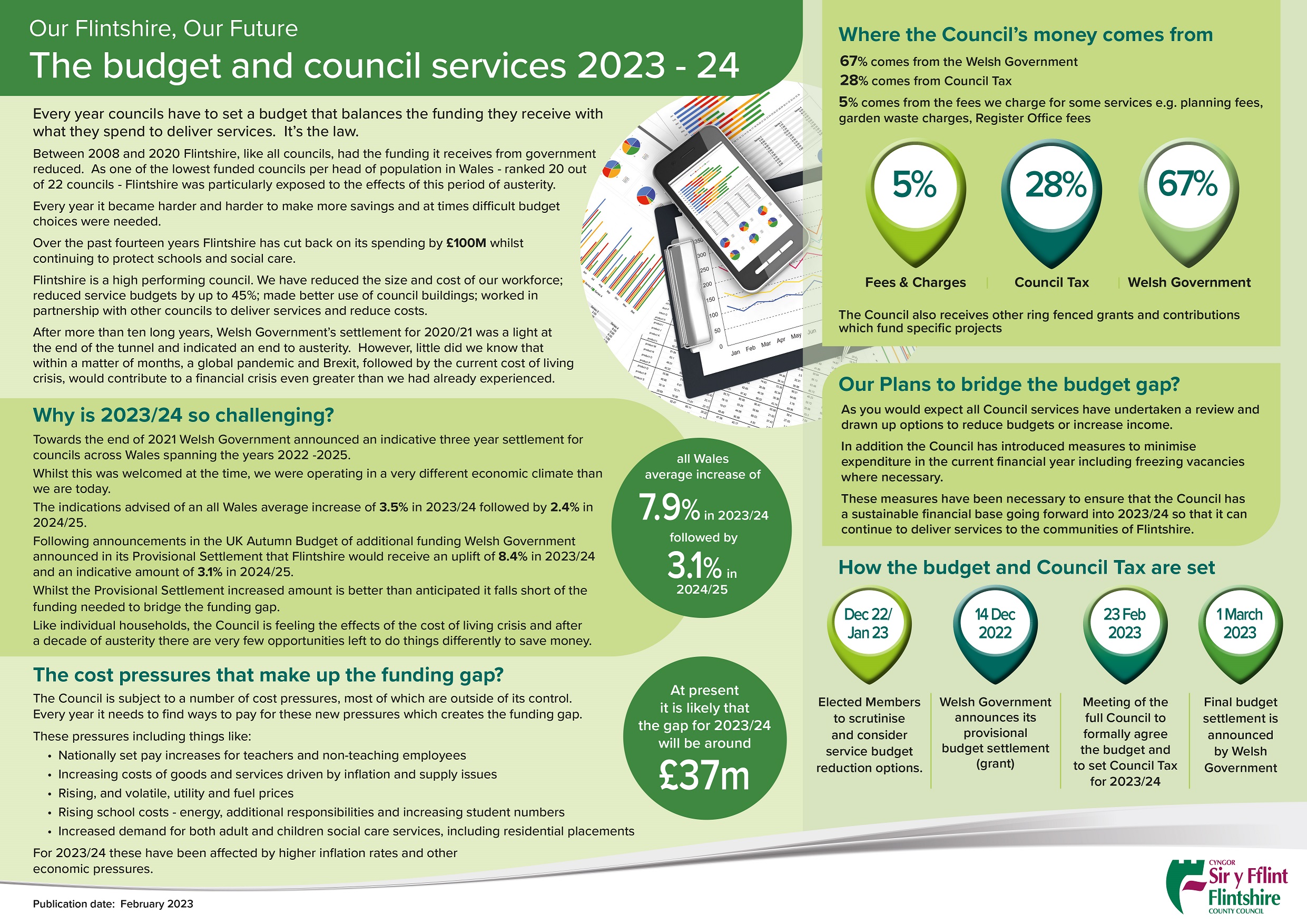

Every year, all Councils have to set a balanced budget. As a low funded council – ranked 20 out of 22 councils in Wales – Flintshire has been particularly exposed to the effects of austerity since 2008. Despite this, over the last 14 years, Flintshire has reduced its spending by £100m.

This year, the Council received an increase in the amount of funding from Welsh Government which amounted to £19.5m for Flintshire.

Whilst this has been good news for 2023/24, going some way to bridge the £37m requirement the Council’s budget, we must continue with our approach of strong financial management as we must set a legal balanced budget and we do not know what challenges we will face in 2024/25.

The increase in funding, while welcomed, must also contend with additional budget pressures faced by the Council, most of which are beyond the Council’s control, including:

- Funding of pay awards (both teacher and non-teacher) must be met by local councils;

- As with all local authorities, the Council continues to experience high and increasing demand for temporary accommodation;

- Other financial pressures include: school transport and out of county placements for social services.

As in previous years, Council has set a clear direction that any annual increase in Council Tax should be at 5% or less.

Taking all of this into account presents the Council with an additional budget requirement or gap of £37m, an overall annual increase of 3.99% is required on Council tax for all Council Services with an additional 0.96% required to meet the cost of additional contributions to North Wales Fire and Rescue Service, Regional Coroners Service and Regional Education Consortium GwE. This equates to an overall uplift of 4.95% and provides overall additional yield of £5.622m in 2023/24.

This amounts to an annual increase of £71.75 per annum and brings the amount to £1,521.33 on a Band D equivalent (£1.38 per week equivalent).

The Leader of the Council, Councillor Ian Roberts, said:

“We have worked hard to ensure that we present a balanced budget and maintain Council services. We are acutely aware of the financial pressures which all households are facing and have therefore kept the element of Council Tax relating to Council service to 3.99%, when taking into account other levying bodies the overall level equates to 4.95%.”

The Council’s Cabinet Member for Finance, Inclusion, Resilient Communities including Social Value and Procurement, Councillor Paul Johnson, said:

“Whilst the increased allocation from Welsh Government for 2023/24 is welcome, it does still present significant challenges to meet the additional responsibilities for workforce and other costs. Despite these challenges, we have still been able to recommend a balanced budget position to Council whilst keeping the annual Council Tax uplift as low as possible. We are a low-funded council that makes efficient use of our resources as regularly confirmed by our financial regulator Audit Wales.”